FolioBeyond Fixed Income Commentary for November 2021

Performance Summary

FolioBeyond's algorithmic Fixed Income strategy was marginally negative in November, returning -0.01% and -0.05% in its dynamic and static volatility versions. The Bloomberg Barclays U.S. Aggregate Bond Index ("AGG") returned +0.30% for the month. Year-to-date, the FolioBeyond strategies have outperformed AGG by 168 and 227 bps in its dynamic and static volatility models, respectively.

The Treasury yield curve flattened further as the 10-year yield declined by 12 basis points while the 2-year yield rose by 4 basis points. Our portfolio continues to be more overweight the short/intermediate sector through Agencies, short Treasury Inflation Protected Securities (“TIPS”), and a modest allocation to short High Yield Corporates and Bank Loans.

Highlight: Realized Volatility and Its Implications

The bond market has been buffeted by a combination of macro factors pulling it in different directions. Inflationary pressures continue to be in the headlines while the Fed has gradually changed its course for unwinding bond purchases and potentially raising interest rates sooner. Covid variants have compounded the challenges for supply-chain related bottlenecks and have made economic growth rates harder to forecast. All of these macro factors have contributed to higher realized volatility for various passive indices. The constantly changing dynamics of the current environment are likely to continue to trigger higher return volatility for standard indices relative to dynamically rebalanced investment strategies.

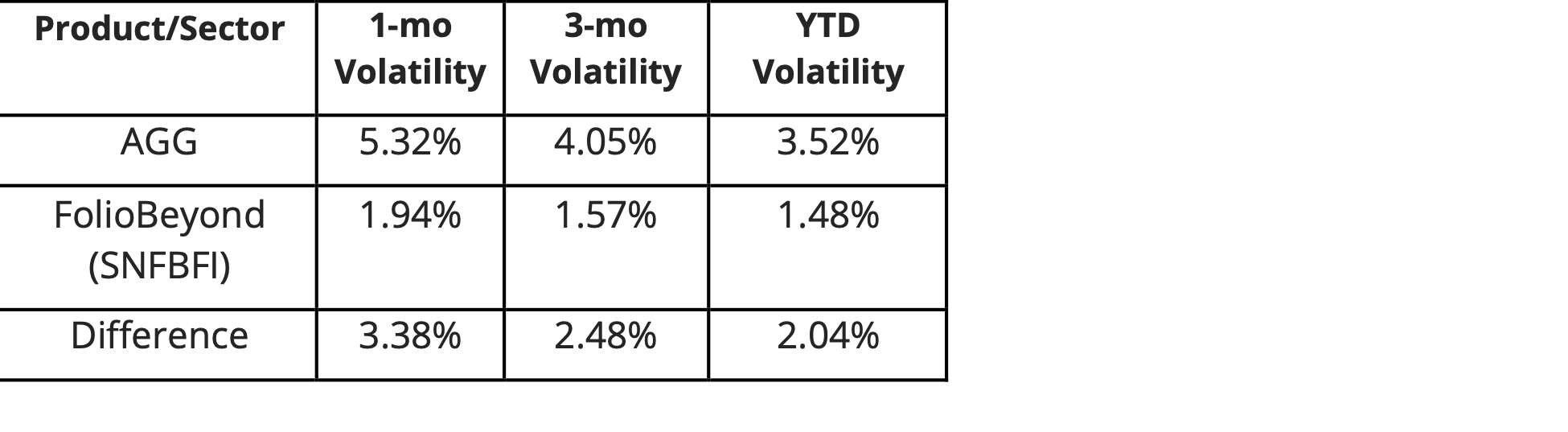

To demonstrate this general effect, we summarize below the recent volatility of AGG vs FolioBeyond’s Optimized Fixed Income strategy over different time periods during this year. The FolioBeyond model underlying the S-Network FolioBeyond Optimized Fixed Income Index (“SNFBFI) targets the long-term volatility of the AGG which has been around 3.5% on an annualized basis. As the table below shows, the SNFBFI strategy has demonstrated lower realized volatility this year than the AGG by a significant margin. Moreover, this disparity has increased recently as the AGG has exhibited much higher 1-month and 3-month volatility levels.

Comparison of Realized Volatilities (Data as of 11/30/21)

What are some of the major drivers of the recent divergence in volatility levels? First, the FolioBeyond model captures changes in the implied volatility levels in the options markets. So, as the market anticipates increases in future volatility, our model captures that effect and incorporates it into the optimization process. Second, the duration of the AGG has extended in recent years due to the longer maturity mix of the index and intrinsic extension of bond duration as the interest component of cash flows become less significant in a low-rate environment. This has meant that as the long end reacts to anticipated Fed actions, inflationary pressures, and Covid-related developments, the volatility of longer rates has amplified the impact on AGG’s total returns. Third, with narrow credit spreads and a flatter yield curve, the benefit of extending out the curve has provided limited incremental returns, reducing the Sharpe ratio of longer duration sectors. Going forward, these drivers of return volatility are likely to persist in impacting overall returns in the fixed income market.

FolioBeyond’s Fixed Income model optimizes the allocations not only based on volatility measures but also incorporates the changing relative value relationships across multiple sectors in the credit and duration spectrums. This dynamic approach allows the model to be both proactive and reactive to market changes and produces portfolio allocations that are updated and optimized as required.

Please contact us to explore how our fixed income optimization model can be utilized within a broad portfolio perspective. As a reminder, our multisector fixed income model portfolios are available on Goldman Sach’s Folio Institutional platform and Boutique Exchange. It is also available as the S-Network FolioBeyond Optimized Fixed Income Index on SMArtX and C8 Technologies. Our algorithm can also be customized and linked to other custodial platforms.