FolioBeyond Fixed Income Commentary For August 2020

Performance Summary

FolioBeyond’s algorithm underlying the S-Network FolioBeyond Optimized Fixed Income Index (“SNFBFI”) returned -0.17% (net of a 30bp annual fee assumption) in July versus -0.81% for the Bloomberg Barclays U.S. Aggregate Bond Index (“AGG”). The 10-year Treasury yield rose by 17 basis points during the month to end at 0.72% yield. SNFBFI’s returns in August were hurt by intermediate/long durations government exposures, partly offset by positive returns in short duration High Yield Corporates and Commercial MBS. In contrast, the AGG experienced a bigger drawdown due to its longer duration exposure.

Source: Morningstar

* SNFBFI’s returns are net of underlying ETF fees and 30 bp assumed management fee. Although the information herein is believed to be reliable, FolioBeyond makes no representation or warranty as to its accuracy, and information and opinions reflected herein are subject to change at any time without notice. The past performance information presented herein is not a guarantee of future results.

** The Rank is calculated using the total return of the S-Network FolioBeyond Optimized Fixed Income Index ("SNFBFI") ranked against the closing total returns of the open-end mutual funds in Morningstar's US Fund Multisector Bond Category. Percentile Rank is the total-return percentile rank of SBFBFI relative to all funds in the defined Morningstar Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100.

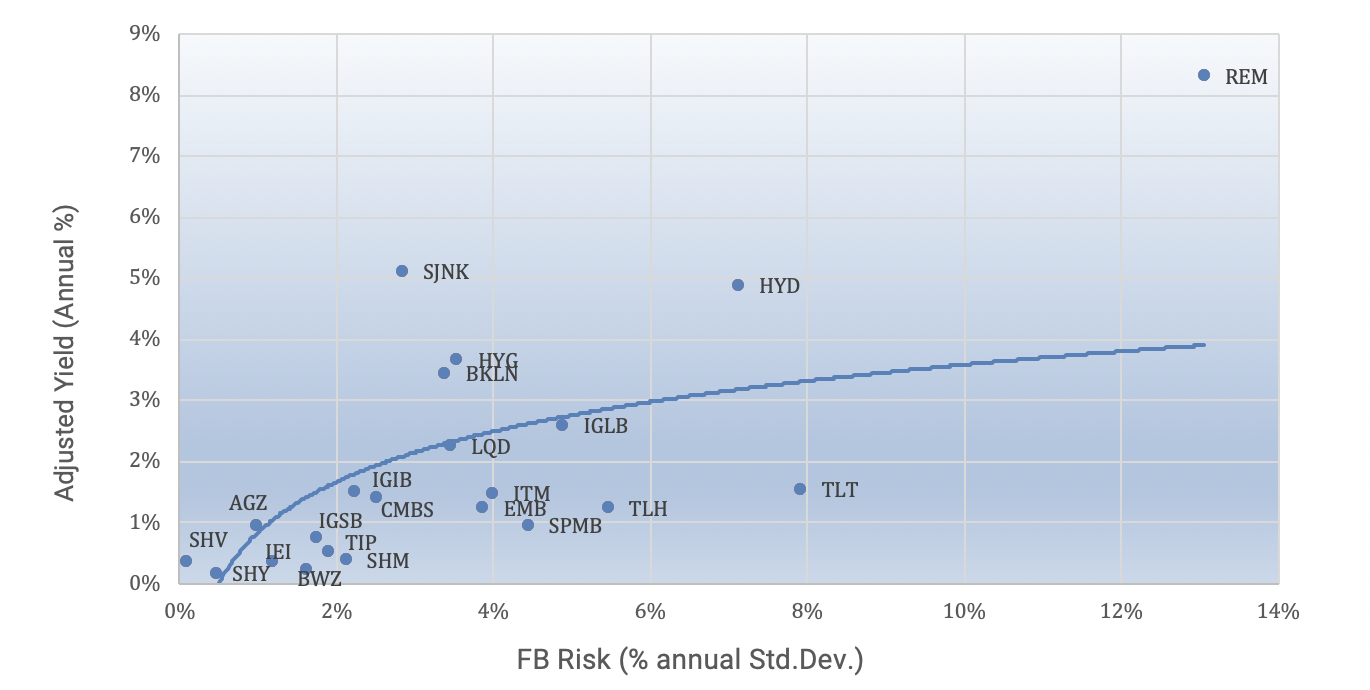

Highlight: Risk-Return Frontier

The diversity in Fixed Income sector Exchange Traded Funds (“ETFs”) has led to the availability of many choices in constructing Fixed Income portfolios. While broader index-based ETFs have generated respectable long-term returns, a large portion of their historical return attribution was derived from passive duration risk exposure in a decades-long bull market in bonds. During this type of one-way move, investors have become complacent about taking duration risk and have relied too heavily on risk analysis based on historical returns. In order to properly assess risk-return trade-offs and analyze the various types of exposures and opportunities available in the Fixed Income market, advanced value and risk analysis can provide valuable insight.

We provide a profile below of the risk/return attributes of 23 subsector ETFs we utilize in our multi-factor approach, in comparison to a more simplistic, historical return-based profile. The first graph shows FolioBeyond’s measures of forward-looking value that captures embedded options, default cost, and other adjustments to enable an apples-to-apples comparison across sectors. On the risk side of the equation, the adjusted risk measure captures various sources of risk ranging from duration, credit spreads, momentum effects, and current implied volatility levels. In essence, the advanced analytics approach attempts to provide a comprehensive risk/return profile of each sector ETF.

In contrast, the second graph shows a simplistic risk/return profile based on 2 years of historical returns and volatility. This backward-looking approach can often overlook important nuances that may have a significant impact on both forward-looking risk and return dynamics. A simple example would be TLH, a long duration Treasury ETF that shows a higher return estimate based on historical measures. On a forward-looking basis, however, this ETF has a yield of a little over 1%, implying a much lower forward-looking value. Another perspective is to look at the break-even rate increase. Given that the 10-year Treasury is at a yield of 0.7%, it would only take a 0.08% increase in the 10-year Treasury yield before an investor would break-even on a total return basis over a 1-year holding period. While the Fed may have more control over short-term rates, the longer maturities are much more tied to market forces including changing inflation expectations.

In addition to the analysis detailed above, investors also need to incorporate correlation effects and other portfolio constraints (such as duration and credit exposure limits) when constructing Fixed Income portfolios. FolioBeyond’s algorithm is designed to allow for investor-specific constraints in offering optimized portfolio solutions. Given this type of framework, investors will be reaching for the optimal point on the efficient frontier of the Fixed Income markets.

FolioBeyond Risk/Return Frontier

Source: Morningstar

Although the information herein is believed to be reliable, FolioBeyond makes no representation or warranty as to its accuracy, and information and opinions reflected herein are subject to change at any time without notice. The simulated risk and performance information presented herein is not a guarantee of future results.

Historical Data Based Risk/Return Frontier

Source: Morningstar

Although the information herein is believed to be reliable, FolioBeyond makes no representation or warranty as to its accuracy, and information and opinions reflected herein are subject to change at any time without notice. The simulated risk and performance information presented herein is not a guarantee of future results.

Please contact us to explore our low-cost, efficiently executed multi-factor strategies. FolioBeyond can construct portfolios with unique risk/return profiles, utilizing our core tactical rules-based approach, which can ultimately play a valuable diversification role as we potentially exit this ultra-low interest rate environment.