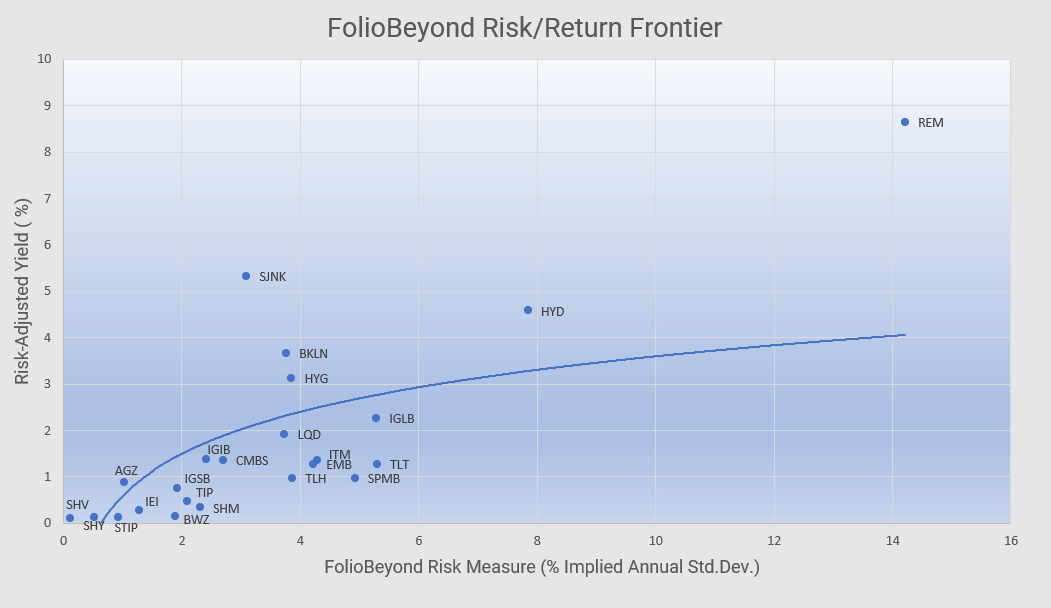

Risk/Return Trade-offs in the Fixed Income Sector ETFs

The graph below shows FolioBeyond’s forward-looking risk and return measures for various sector ETFs in a scatter plot. This overview should be helpful in providing a snapshot of what various Fixed Income sectors offer in terms of risk-adjusted yield, after accounting for embedded risk factors such as options and defaults, in relation to our proprietary multi-factor risk measure.

Advanced analytical measures are important in accurately assessing sector strategies when constructing optimal portfolios. The interplay of risk, when accurately measured across sectors, versus expected return, adjusting for relevant sector risks, should be the foundation of any Fixed Income portfolio construction.

Please contact us if you would like more information on our analytical process and how it can be applied to most liquid Fixed Income ETFs.

Source: FolioBeyond analytics and Bloomberg

Although information herein is believed to be reliable, FolioBeyond makes no representation or warranty as to its accuracy, and information and opinions reflected herein are subject to change at any time without notice.